Unlock the full potential of your investment portfolio by understanding tax loss harvesting strategies that can help minimize your tax bill and maximize your returns.

What Is Tax Loss Harvesting and Why Does It Matter?

Tax loss harvesting is a portfolio management strategy that involves selling securities at a loss to offset realized capital gains and reduce overall tax liability. For investors, particularly those with substantial taxable investment accounts, this practice can be a critical component of a tax-efficient investment approach. By strategically realizing losses, investors can defer or minimize the taxes owed on gains elsewhere in their portfolio, improving after-tax returns over time.

This technique is especially relevant in volatile markets, where temporary declines in asset values can be harnessed to create tax advantages without permanently altering the asset allocation or long-term investment strategy. For high-net-worth individuals and near-retirees, such as executives, professionals, and business owners, tax loss harvesting can play a significant role in wealth preservation and retirement planning.

How Tax Loss Harvesting Works: The Essential Steps

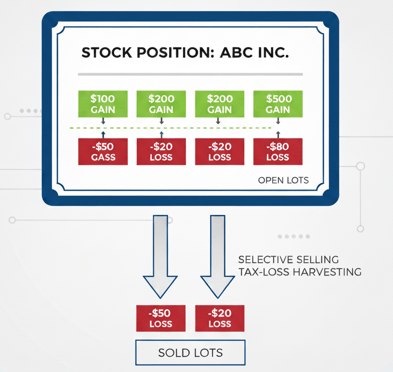

The tax loss harvesting process begins by identifying portfolio positions that are currently trading below their purchase price. The next step is to sell these underperforming assets, thereby realizing a capital loss. This realized loss can then be used to offset capital gains incurred from the sale of other securities, reducing the investor’s taxable income for the year.

Even when a holding has appreciated overall, individual tax lots within that position may still show a loss. For example, an investor who purchased shares of the same fund or stock at different times and prices may have some lots that are underwater while others are in the green. Those losing lots can be sold independently to realize a tax loss, without liquidating the entire position or disrupting the overall investment exposure. This granular approach allows for precision in harvesting losses while maintaining the portfolio’s strategic allocation.

If total capital losses exceed capital gains, up to $3,000 of excess loss can be used to offset ordinary income annually, with any additional losses carried forward to future tax years. It is crucial to adhere to the Internal Revenue Service’s (IRS) wash sale rule, which prohibits purchasing a substantially identical security within 30 days before or after the sale that generated the loss, as this would disallow the tax benefit.

The wash sale rule applies only to purchases that are considered substantially identical to the security sold. This distinction provides some flexibility for investors who wish to remain invested in a particular market segment while harvesting a loss. For instance, if an investor still believes in the long-term prospects of a holding but wants to realize a tax loss, they can sell that position and purchase a similar, but not identical, ETF or fund that tracks the same general area of the market. This strategy helps maintain exposure and participation in potential near-term gains while still capturing the tax benefit of the realized loss.

Common Mistakes to Avoid When Harvesting Tax Losses

One of the most frequent errors investors make is inadvertently violating the wash sale rule, which can negate the intended tax benefit. Another common mistake is allowing tax considerations to override the fundamental principles of asset allocation and risk management—selling high-quality assets solely for tax reasons can undermine long-term portfolio goals.

Additionally, some investors may focus too narrowly on short-term tax savings without considering the potential for long-term capital appreciation. It is essential to balance tax loss harvesting activities with a disciplined investment process that prioritizes diversification, risk-adjusted returns, and alignment with personal financial objectives.

Integrating Tax Loss Harvesting into Your Investment Plan

Tax loss harvesting should not be viewed as a one-time event, but rather as an ongoing element of a comprehensive investment and tax strategy. This approach involves regular portfolio reviews, active monitoring of unrealized gains and losses, and timely execution to capture losses as opportunities arise throughout the year.

By integrating tax loss harvesting into a broader wealth management plan, investors can enhance after-tax returns, manage portfolio risk, and support long-term financial goals such as retirement income, legacy planning, or funding education expenses. Consistent implementation, combined with a focus on asset allocation and risk management, ensures that tax efficiency is achieved without compromising the integrity of the investment strategy.

Leveraging Professional Guidance for Optimal Tax Strategies

Given the complexity of tax regulations and the nuances of portfolio management, collaborating with experienced professionals can significantly enhance the effectiveness of tax loss harvesting. Financial advisors and tax professionals provide valuable insight into the timing, selection, and execution of loss harvesting strategies while ensuring compliance with IRS rules and optimizing outcomes.

At Barry Investment Advisors, our team takes a holistic approach to tax-aware investing, integrating tax loss harvesting with comprehensive financial planning and ongoing portfolio oversight. By leveraging professional expertise, investors can navigate regulatory complexities, avoid common pitfalls, and maximize the long-term value of their investments in alignment with their unique goals and risk tolerance.