Podcast

Market Update

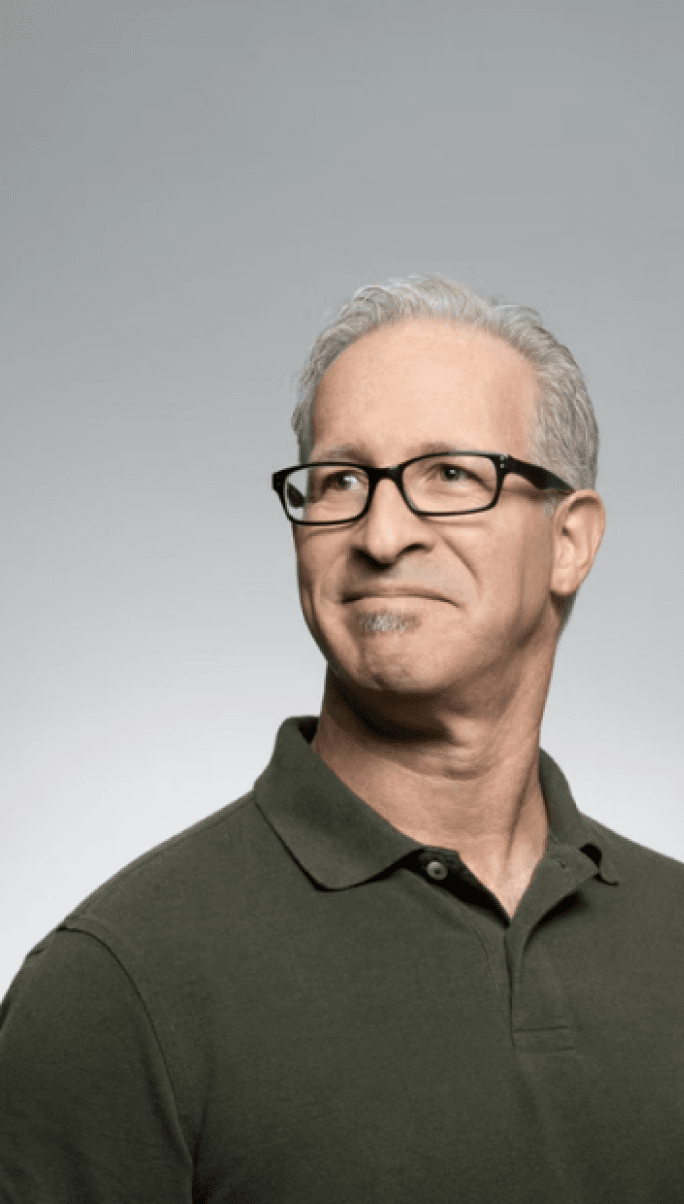

Joe Barry reflects on a remarkable year across global markets. This update explores how leadership may be shifting away from an expensive U.S. market toward opportunities abroad.

We focus on supporting your financial life so you can focus on what's really important: your family, your career, enjoying your financial freedom, and your legacy. We do a lot for the people that trust us with their wealth, but it all comes down to financial planning and investment management.

Regardless of where you want to go, your team at Barry Investment Advisors is here to support you and your family at every step of the journey.

We help you protect and grow the wealth you've worked so hard to build, using our global value investment philosophy and decades of experience.

At Barry Investment Advisors, we live by the Golden Rule… squared. We treat you the way that you want to be treated. Not the way we want to be treated, and not the way that other clients want to be treated.

Have a question on your mind or ready to see what it's like to work with our team? Schedule a 20-minute Ask Anything session today.

Since 2007, our team has been serving the unique needs of five types of investors and their families. If one of these investors sounds like you, it's very likely that our team would be a good fit to support your wealth management objectives.

Retirement is a big step, and we can help you prepare for everything that comes next.

During retirement, confidence opens the door to everything else. We can help you find peace of mind, and so much more.

We help families manage their wealth and empower the next generation of family leaders.

We can help you manage the moving pieces of your financial life and capture the opportunities of equity compensation.

We believe that education and financial empowerment are the building blocks of financial independence.

Throughout the year, we publish articles and blog posts covering key financial planning, wealth management, and tax topics.

Joe Barry reflects on a remarkable year across global markets. This update explores how leadership may be shifting away from an expensive U.S. market toward opportunities abroad.

Sometimes investing feels like detective work. You follow trails of breadcrumbs, piecing together scattered clues from data, headlines, and sentiment to uncover what’s really driving the markets. In my last market update, I noted it was too early to tell how tariffs and trade frictions would affect the economy. A few months later, we have better clues. The data now shows competing narratives about where growth, inflation, and the markets may go from here.

When you sit down with a holistic financial planner, one of the first questions might catch you off guard:

“What does money mean to you?”

It’s not just about spreadsheets or stock picks. It’s about your story.

As with any values-based question, there is no wrong answer. But for many people, this question can feel confusing or even intimidating. If your first thought is, “Money is money,” you’re not alone.

Have a question on your mind? Book your complimentary session today.