“To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What's needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework.”

Benjamin Graham

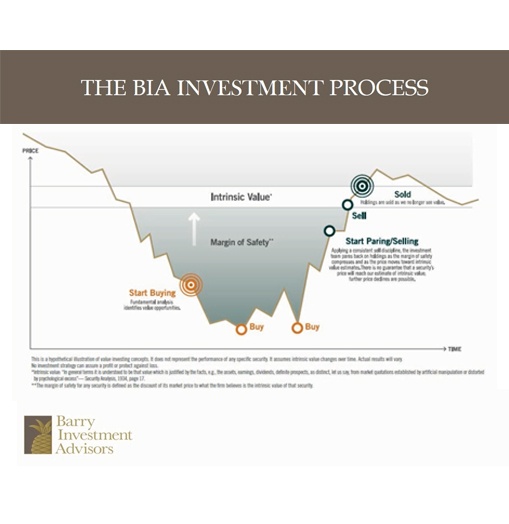

Our investment approach is best described as Balanced Global Value. Balanced refers to the blending of equities, fixed income, alternative investments, and cash. By Global, we mean that international as well as US securities are included. Value refers to an equity selection technique that follows the traditional Graham and Dodd approach which is focused on quality companies priced favorably relative to earnings and book values. We blend this approach with thematic mutual fund investments for diversification.

Why do we take this approach? It is because value investors think like business owners and, as a result, this approach has statistically been shown to generate superior

Client portfolios are monitored by a sophisticated system that alerts your team at Barry to any material changes within your portfolio. Particular attention is paid to any corporate event that weakens the company's financial position. We believe that changes to the price-to-earnings ratio and other valuation metrics determine whether an equity has become overvalued. Quality and valuation changes are the most common reason for a sale recommendation from our investment committee. Mutual funds, exchange-traded funds, and closed-end funds are leveraged for thematic investment areas when appropriate.

The investment advisors at Barry Investment Advisors are very experienced at managing investment portfolios. With that being said, our team is committed to continually enhancing our approach to investment management, client service, and support. Our team leverages outside resources when appropriate and attends conferences to continue our professional growth, including Grant's Conference, Mauldin Strategic Investment Conference,

We understand that you have a sea of options to choose from when it comes to where and how your money is managed. If it sounds like Barry Investment Advisors may be the right fit, we invite you to contact us today. We will use this opportunity to learn more about your unique financial goals and to explain a bit more about the work we do for clients at Barry Investment Advisors.

Our investment process can be broken down into six critical steps. Here is the process you can expect when you become a valued client.

We develop an understanding of your appetite for market risk. We analyze your goals, income, needs, and investment time horizon. We put this in writing, through an investment policy statement.

How are you positioned today? We explore your current investments, review tax implications of making any changes, and consider how changes will impact the diversification of your portfolio.

We propose

Next, we get to work implementing your recommendations using best-in-class funds, ETFs, and individual holdings. Just as important, we analyze the impact of fees from these holdings.

Once your investment strategy is implemented, our work has just begun. We constantly monitor your portfolio, looking for ways to capture excess returns and insulate your holdings from market risk.

Through phone calls and regularly scheduled meetings, we will review your holdings, discuss market conditions, and address any questions that you may have. We want you to understand why you own the companies that you do.