Market Update - October 2023

On this edition of Barry Investment Insights, Joe Barry delves into the current market scenario, highlighting three key points of concern for investors:

- The unprecedented surge in interest rates and its ripple effect on stocks and bonds;

- Challenges faced by the real estate sector, both residential and commercial, due to these high rates; and

- The balancing act of the Federal Reserve in combating inflation and its implications for the economy.

To get a detailed understanding of these trends, listen to the full podcast.

Market Update - June 2023

On this episode of the Barry Broadcast, Joe Barry provides a market update covering three important trends impacting investors this year, including: The rapid growth in AI-related stocks, why rising interest rates are benefiting fixed-income allocations, and how the recent growth in ETF offerings has helped investors.

January 2023 Market Commentary

During 2022, investors dealt with numerous shifts that dethroned previously high-flying tech stocks and underwent one of the fastest rate hike cycles the current generation has experienced. Moving on to 2023, we see the upcoming years as an exciting time to be a fundamental investor—especially for those who are not limited by geographies or style boxes—and better equipped to handle today’s fast-moving economy and markets. Click on the link below to read about the positive developments related to many of the companies we focus on.

A Market Update from Joe Barry, CFA and Kate Alves, CFP® - September 2022

In this edition of the Barry Broadcast, Joe and Kate discuss the current market environment and how your team at Barry is responding to it.

A Market Update from Tyler C. Craig, CFA - August 2022

In this edition of the Barry Broadcast, Tyler Craig discusses the market dynamics that we have been monitoring over the last several months.

Watch this broadcast to get an update on:

- The pace of inflation in the U.S. and abroad

- The historic year we have seen for the bond market

- Our expectations for interest rates moving forward

- Consumer and labor market sentiment

A Market Update from Joe Barry - May 2022

In this edition of the Barry Broadcast, Joe Barry discusses the state of the global capital markets as we move through 2022.

Listen to the broadcast to hear:

- How recent price action compares to past moments of market unrest

- What this selling pressure means for market leadership

- The state of the corporate bond market and corporate debt in America

- What your team at Barry is doing to navigate this challenging market environment

Listen to the podcast using the button below, and don't hesitate to reach out if you'd like to discuss any of the topics covered or your personalized wealth management strategy.

Global Market Commentary - May 2022

Thanks to Nick Murray for the commentary below. These are our thoughts exactly. We hope you enjoy reading it and find it informative.

Global Market Commentary - March 2022

We hope you are having a good start to the year. Given current events, we believe it important to share the team’s thoughts on the state of the market and our strategic outlook for 2022. Year to date, the S&P 500 has declined 11%. The Nasdaq is down about 18%, gold investments are up about 10%, and commodities as a group are up over 40%.

Interest rates have risen, causing the market to lean toward those companies or sectors (energy and financials for example) who often benefit from a rising interest rate environment. During times like these, investors typically tend to shift their appetite toward companies with predictable cash flows and dividend payments, supplementing income to combat the effects of higher inflationary costs. Despite inflationary headwinds, many companies’ earnings results have met or exceeded expectations this earnings season.

Negative sentiment seems to have taken hold where companies need to meet high future growth hurdles. Stocks that have gone viral online (i.e., GameStop and Peloton to name a few) and businesses whose margins are impacted by higher input costs are some of the affected areas. We anticipated this environment and as a result, have avoided purchasing these types of companies.

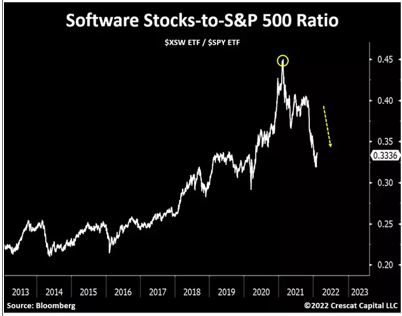

At Barry, we are enthusiastic about the explosion of technology and of the innovation that has taken place in the world. However, we also note that investor sentiment in the technology space perhaps became too exuberant as interest rates fell. Below you can see the recent shift away from high priced tech stocks and we believe investment opportunities in this sector are developing in names that were too expensive for us just a few months ago.

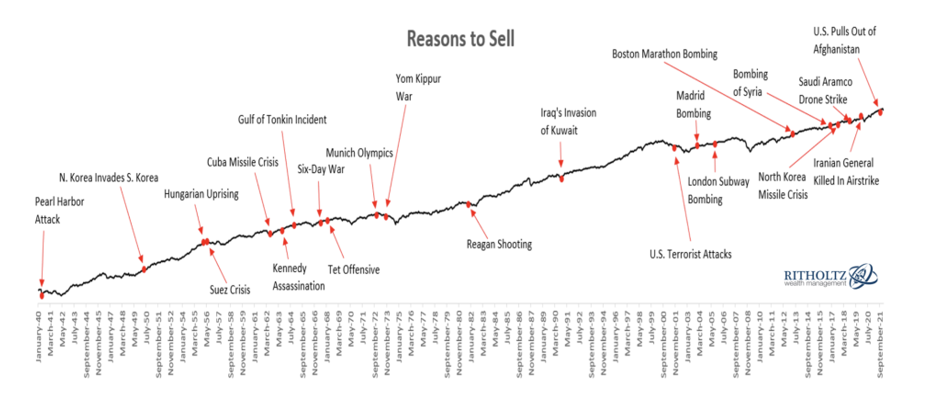

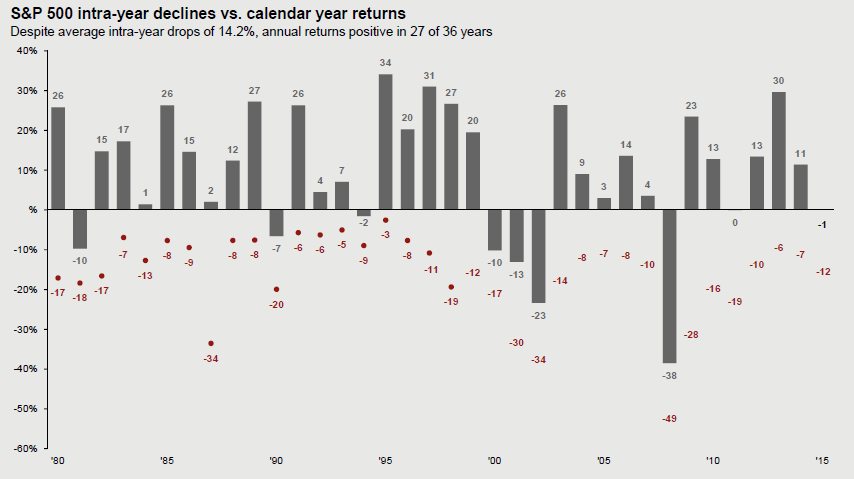

Current market swings are not unusual. Looking back, between 1924 to 2021, up to a 10% decline has occurred almost annually and a 20% or greater decline has occurred approximately every five years. Geopolitical events have impacted the market historically, with the latest being Russia invading Ukraine.

In times like these, even long-term investors with well-crafted financial plans get tempted to sell. Below shows the many events over the last 80 years that caused investors to sell, which, in hindsight, has proven to be short-sighted.

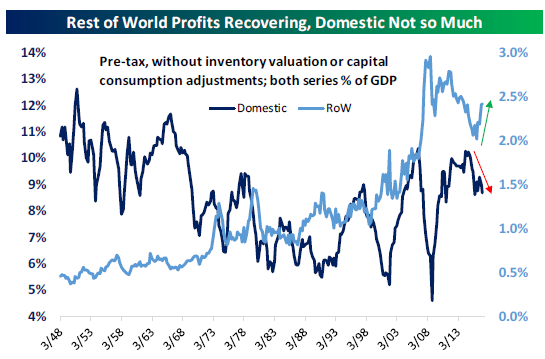

Historically, it has generally been wise to consider out-of-favor investments. Recent events are illustrating how important natural resources are to countries for security and prosperity, resulting in higher investor demand in these areas. Also, international equity investments are at record valuation discounts to U.S. investments. The opposite of a bubble. This is another area worth selectively owning.

We believe that a well-balanced portfolio should be able to weather volatility. Times such as these provide opportunities to buy and rebalance your portfolio at lower prices. We are optimistic regarding increasing our investment in quality companies and funds at reasonable prices this year.

We remain strategically focused with all eyes forward to assess any new and developing trends. We also pray for a safer and more peaceful world. Please reach out to our investment team for any questions you may have. We appreciate your trust and confidence in us and look forward to continuing to work with you and your family.

Global Market Commentary - July 2021

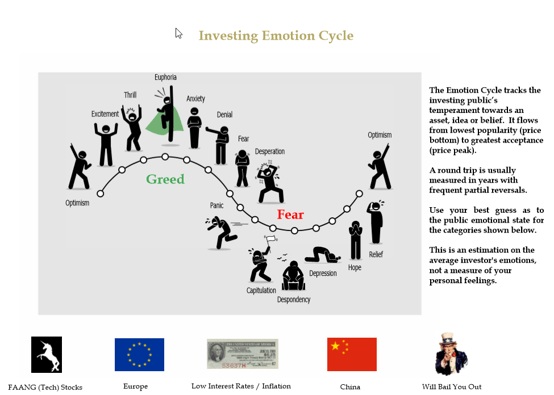

In this month’s podcast, Joe Barry discusses the investing emotion cycle. Watch the video and see if you can gauge where the public’s temperament is on six key investing topics: inflation, junk debt, FAANG stocks, real estate, cryptocurrency, and the government’s ability to bail out markets.

Global Market Commentary - March 2021

In this month's podcast, Joe Barry, Pat Barry and Kate Alves sit down to discuss hot topics in the marketplace right now. Please click on the link below to hear their discussion on GameStop, inflation, mortgage rates, the recent Stimulus Plan as well as emerging trends in the markets today.

Global Market Commentary - 2020 Year-End Review

In this month’s podcast, Joe Barry sits down to discuss the financial markets in 2020, a year that was unlike any other. Specifically, he covers the financial and economic “firsts” that we saw this year: the expanded use of negative interest rates, frantic buying of electric vehicle stocks, and never-before-seen participation in the options market, to name a few things. As always, we invite you to connect with the team at Barry if you have any questions about the information that is covered.

Global Market Commentary - 2020 Election

With the U.S. election just days away, Joe Barry sat down to discuss how the election may, or may not, impact the economy, equity prices, and taxes. The historical data that he referenced on the podcast can be found here.

We know that these are uncertain times for you and your family. The team at Barry remains committed as ever to your financial well-being, and we are here if you’d like to connect during the coming days.

Global Market Commentary IV - COVID-19

In our fourth podcast during the COVID-19 pandemic, Joe Barry, Pat Barry, Kate Alves and Dan Pinheiro discussed questions that we've recently gotten from clients. Several of the key discussion points are shown below, and you can listen to the full podcast using the button at the bottom.

-

What has been the impact of stimulus from the Fed and U.S. Government? The U.S. government and Federal Reserve provided massive fiscal stimulus since our last podcast. This action has supported the market following the March 23rd lows. In particular, this action has helped calm the corporate bond market. While the market has responded positively, there is still a lot of uncertainty in the markets right now.

-

What are the long-term implications of the pandemic on consumer habits? In terms of historical lessons, we can look to the Great Depression. The generation that came out of the depression (the parents of many of our clients) was very debt-averse. We could see COVID-19 have the same impact on consumer spending habits, where Americans are more frugal with their money and only purchase items that they have the cash flow to support (rather than relying on debt financing). The net impact could be a decrease in per-capita spending in the years and decades following the pandemic.

-

What sectors may benefit from changing consumer habits? We talk a lot about the needs versus wants for U.S. households. Companies that provide needed products and services will likely have an edge when compared to companies that provide discretionary products or services.

If you have questions about your portfolio or our thoughts on the markets, please call your team at 888-992-8601.

The CARES Act: Key Points To Consider

Last Friday, President Trump signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act into law. This bill was massive in size and scope: at $2 trillion in economic stimulus, loan guarantees, and direct payments, the bill amounts to roughly 9% of 2019 U.S. GDP.

The legislation itself was over 880-pages long, and it addressed everything from unemployment insurance to minimum required distribution requirements from retirement accounts, to direct cash payments from the US Treasury. The exact repercussions of the bill will become clearer in the week and months ahead, but below you will find a summary of the key points. As always, please reach out to your team at Barry Investment Advisors if you have any questions about the bill itself or how provisions within the bill might impact your wealth management strategy.

Retirement Plans: There were several provisions in the bill that may impact your retirement accounts and broader wealth management strategy.

-

If you have been economically impacted by COVID-19, you may take up to $100,000 from a traditional IRA without paying the 10% early withdrawal penalty. You will still need to count the withdrawal toward in 2020 ordinary income, but you will have three full years to pay back the tax liability.

-

If you are over the age of 72 or if you have an Inherited IRA, you do not need to take your Required Minimum Distributions (RMDs) in 2020.

Impacted Sectors: The bill included money for sectors that have been hit especially hard by stay-at-home orders and the associated stall in commerce. These capital injections do come with strings attached. After the loans are paid back, companies that receive funds may not buy back stock for one year and any executive earning more than $425,000 may not receive a raise.

-

$50 billion for passenger airlines and $8 billion for cargo airlines. Half of these funds are designed to cover employee wages, salaries, and benefits, while the other half are structured as loans.

-

$17 billion for companies “deemed important for national security”. Much of this money is destined for Boeing, who manufactures the F-18 Super Hornet and has struggled financially following two deadly crashes of their 737 MAX passenger airliners in 2019.

Small Businesses: A large portion of the stimulus package was directed toward small businesses.

-

$350 billion in small business loans that can be used toward salary, wages, and benefits. With a maximum loan amount of $10 million, these loans can be used to cover up to 250% of an employer’s monthly payroll.

-

For businesses that have been forced to close OR see sales decline by 50%, they may capture a tax credit equal to 50% of all wages paid during the pandemic.

-

Half of small business payroll taxes may be deferred for 2020. The first half of these taxes will be due in 2021 and the second half will be due in 2022.

The Healthcare Sector: The bill also included money for states, counties, and hospitals as they work to contain the spread of COVID-19.

-

$117 billion toward veteran’s healthcare and hospitals

-

$16 billion toward federally-owned pharmaceuticals and medical supplies

-

Health plan providers are now required to provide preventive care that is directly related to COVID-19 without copayments.

Unemployment Insurance: On Thursday, the Labor Department reported that 3.28 million unemployment claims were filed the week ending March 21st. By comparison, the worst week during the Great Recession and correction of 1982 saw 665,000 and 695,000 unemployment claims filed, respectively.

-

The bill provides direct payments of $1,200 to individuals, $2,400 to married couples, and $500 for each child under age 17.

-

These payments will phase-out based on income. The phase-out starts at $75,000 for individuals, $122,500 for head of households, and $150,000 in annual income for married filing jointly. Income levels are defined by your 2019 tax return if you have already filed and your 2018 tax return if you have not yet filed your 2019 return.

-

The exact timing and process for these payments is still unclear, but Treasury Secretary Steven Mnuchin has said that checks will be sent within three weeks of the bills signing.

-

Also of note, federal loan payments (and the associated interest charges) have been suspended through September 30th.

As we said, there are many moving pieces to the CARES Act. If you would like to know how this will impact your financial plan please contact your Financial Planning Team at planning@barryia.com or 888-992-8601.

Global Market Commentary III - COVID-19

Investment markets continued lower this week, as fear around Coronavirus weighed on equity prices. Today, Joe Barry sat down for the third market update covering the unrest. The full podcast can be found at the bottom of this email, but the executive summary of his thoughts are below:

-

Since last week, the level of stress and fear within the market has intensified.

-

Every industry and class of debt got liquidated this week. This was very unusual.

-

We've talked about companies that live paycheck-to-paycheck as a risk during a market downturn, but it's becoming clear that American families living paycheck-to-paycheck are the real concern right now.

-

One encouraging thing in all of this: China is returning to "business as usual" and we can use China's experience as a guide to determine how long this might last in the United States.

-

Interest rates are likely to stay low for the foreseeable future so, as we mentioned last week, dividend-paying stocks will continue to be a key asset in the weeks and months ahead.

-

There is no way to know when the bottom will be, it's our job to build the best possible portfolio to get through this difficult period and to set the stage for many years to come.

-

Your team at Barry is operating at full strength and ready to assist you and your family as needed.

Global Market Commentary II - COVID - 19

Again, markets closed sharply lower yesterday. At the closing bell, the Dow Jones Industrial Average was off 9.99%, gold was down 4.04%, and oil was down another 6.03%.

Joe Barry, Pat Barry, and Kate Alves sat down to discuss yesterday’s selloff, how it compares to past corrections, and where things may be headed next.

The full podcast can be found at the bottom of this email, but a summary of our thoughts are below:

-

Two distinct shocks have driven markets lower

- the commerce disruption from COVID-19

- the decision by OPEC to flood the oil market

-

Human emotions are driving volatility, but recent price movements are being augmented by trading algorithms.

-

As markets fall, we are closely tracking companies that are becoming value investment opportunities. Your accounts have a strong cash position and we are now looking to put this money to work. With that said, we do not want to deploy this cash reserve too quickly.

-

With interest rates sharply lower, dividend-paying equities will be an even more important part of our strategy going forward.

-

These market events tend to shake-up “market leadership.” Technology stocks (FANGs) have dominated the 2010s, but the marketplace may look different during the 2020’s.

-

There are a lot of unknowns surrounding COVID-19, but also many knowns. Click here to read a great FAQ.

-

Your team at Barry is working hard to identify opportunities and protect client portfolios.

Finally, we want to make you aware that the team at Barry has a Business Continuity Plan that allows us to continue to serve you in uncertain times. You can be confident that someone from our team will be available to address your question or request just as we always have.

If you have questions about your portfolio or our thoughts on the markets, please call your team at 888-992-8601.

Global Market Commentary I - COVID - 19

This week, tension about the Coronavirus (COVID-19) pushed global markets sharply lower. Specifically, investors are concerned about how preventative measures against the virus (like city-wide quarantines) are impacting the flow of parts to factories and goods to stores.

But this isn't the first time that we've seen a virus bring volatility to global markets, and Joe Barry sat down today to discuss the historical context of the Coronavirus outbreak. Most importantly, he shares his ideas on what this all means for the market going forward. If you have any questions about investment markets or your portfolio, we invite you to pick up the phone and connect with your team at Barry.

Global Market Commentary (January 2020)

Last year at this time, the Federal Reserve was trying to raise interest rates, and investors were in a sour mood for the holidays. This year it is just the opposite - with some indices printing 30% gains during 2019 and a lot of euphoria in the marketplace.

All of this is a bit strange - especially when you consider that corporate profits remained relatively stagnant year-over-year. In our most recent podcast, Joe Barry discussed why markets have been trading higher and what to watch for in the New Year.

Listen to this podcast by clicking below, or reach out directly to your team at Barry if you'd like to discuss the information covered.

Global Market Commentary (November 2019)

Over the last several weeks, we’ve been using our Investor Emotion Cycle quiz during client meetings. In this podcast, we wanted to take a moment and discuss each topic covered in detail.

Listen to the podcast below to hear our views on the Investor Emotion Cycle.

Global Market Commentary (June 2019)

For this month's podcast, our team sat down to discuss the ongoing trade war with China, the state of the IPO market, and global oil production. Click the link below to listen to the full 25-minute broadcast covering our thoughts on what has been driving global markets and where they might be headed next.

Global Market Commentary (January 2019)

In this podcast, Sean Corkery sat down with Joe Barry, Pat Barry, and Kate Alves to discuss the trends we saw in 2018 and what our expectations are for 2019. Additionally, we reflect on how today’s price action compares to past moments of market unrest and share the “golden rules” of value investing that guide our approach.

Global Market Commentary (October 2018)

With markets down roughly 5% this week, we want to share some insight on what we have been seeing and where markets may be headed next. This week's decline was interesting, as it occurred with very little geopolitical or economic news to drive prices lower. Fundamentally, we believe that the market is starting to respond to some of the concerns that we've been discussing for the last several quarters: over-inflated price/earnings ratios, aggressive investor behavior, and a bit of irrational exuberance for companies that have yet to prove their business model is profitable. Listen to the full audio commentary below, and please reach out to your team at Barry Investment Advisors if you have any questions or would like to discuss.

Global Market Commentary (September 2018)

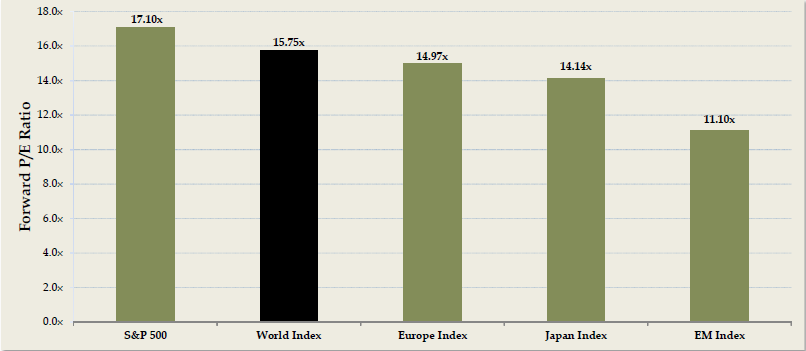

Joe Barry, Founder of Barry Investment Advisors, sits down to discuss the state of US and international equity markets on this month's market update. On the podcast, you will hear Joe's take on asset allocation strategies, opportunities that exist within gold, and the valuation of global equities relative to what we are seeing domestically. Click the link below to listen to the full podcast, and reach out to the team at Barry if you have any questions about the topics or ideas discussed.

Global Market Commentary (April 2018)

Sean Corkery, CFA®

Global Market Commentary (February 2018)

Volatility has returned. After 15 months of daily returns no worse than a 2% decline, the S&P 500 snapped the winning streak by posting a 2.1% decline on Friday. On Monday, the decrease nearly doubled, with the index posting a 4.1% fall. For many, Monday’s action was breath-taking. But it was not extraordinary. Since its inception more than 100 years ago, the Dow has registered a daily decline of 3+% 359 times.

We have been anticipating a correction for more than year and expected more choppy markets in general, as market valuations became stretched with nearly daily increases in stock prices. A rocket-fueled first 18 trading days of 2018 added to our concerns, as the S&P 500 jumped 7.5%, nearly matching its decades-long average annual return.

And then Friday happened. That day, the Department of Labor released a strong payrolls report that had better than market expected results. But with the report, came hard evidence of wage inflation returning. The market interpreted the report as a turning point for inflation. If wages rise too fast, the Fed may accelerate interest rates hikes to head off inflation. And when interest rates rise, as they have been doing more rapidly recently, investors can get temporarily spooked. In addition, rising wages can negatively impact corporate profit margins, slowing earnings growth rates and dampening stock valuations. The S&P 500 gave back January’s gains to finish down .92% YTD.

We will continue to monitor economic data as it is released but believe a single payrolls report does not make a trend. We don’t see signs of a recession. We are encouraged by the recent corporate earnings reports for the fourth quarter and commentary surrounding expectations for 2018. Following Monday’s selloff, the S&P 500 is trading at 17 times 2018 earnings estimates. We project estimates to move higher as analysts have yet to adjust earnings higher to account for lower corporate tax rates in 2018. If earnings and dividend payouts continue to come through ahead of expectations due to the extra tax savings, there is plenty of potential for US companies to resume growth from here.

Over the past year, we have positioned portfolios for a US stock market correction by rotating out of some US names and allocating further to international markets funds. We expect to do more of this in 2018. Our balanced portfolios include inflation-protection positions, a volatility managed fund, and geographic and sector diversifications.

You can see below that for this market selloff, the US (S&P 500) and international markets (EAFE Index) fell in sync (top two lines of the chart). The bottom two lines reflect long-term treasury prices in blue, with the gold price above it.

While we expect US earnings to continue to improve, we also think the acceleration of international earnings growth will continue, and will look to add selectively as opportunities present themselves. Like with every prior market correction, this one will end.

We appreciate your continuing support. Please do not hesitate to contact us if you have any questions.

The Barry Investment Team

Global Market Commentary (2017)

One of our “can’t miss” reads is Saturday’s session with Barron’s, the weekly financial magazine. In a recent edition, Vito Racanelli penned the cover story titled, Europe on Sale: Time to Buy Foreign Stocks. In the article, Racanelli contends that overseas markets are cheaper than U.S. markets and with an improving economic backdrop, are poised to outperform. As global value investors, we are naturally interested in the author’s findings and thought it was appropriate to share the highlights and our views.

The S&P 500’s long-term dominance over the European indices may be about to end. Future outperformance will likely be driven by profits. Corporate earnings of companies in the EAFE Index (index of developed markets outside the US and Canada) remain 45% below the prior peak, while S&P 500 companies’ earnings have far exceeded 2007 levels. Furthermore, with higher fixed costs, EAFE companies have higher leverage to revenue growth: a 1% gain in revenues produces a 2.8% increase in profits, while a 1% gain in revenues at U.S. companies translates to a 1.8% jump in earnings. It is worth noting that in Japan, the 1% revenue gain translates to 3.6% of profit growth.

Despite the impressive 2017 performance of the EAFE Index, valuations remain very attractive. Based on estimates, its price to earnings ratio (P/E) is 15.3 and the Dividend Yield is 3.2%. The S&P 500 has a P/E of 18.2 and a Dividend Yield of 2.0%. Historically the U.S. premium to the EAFE index P/E has been 1.0-1.5, well below the current 3.0.

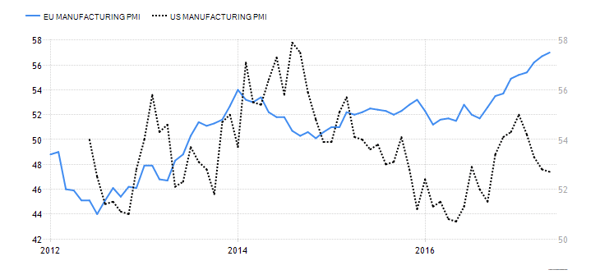

Optimism for the global economy has clearly been rising. Starting with Europe, key economic indicators have been flashing green with improvements and surprises to the upside since the summer of 2016. The Purchasing Managers’ Index (PMI), a surveyed indicator of economic health, reached the highest level in the last three years for Germany, France and the Eurozone. The Eurozone Manufacturing PMI posted nine consecutive months of increases and reached the highest level since April 2011. Unemployment in the Eurozone has improved to 9.5% from 12.1%.

Source: www.tradingeconomics.com

In May, the European Central Bank (ECB) took notice, lifting its domestic GDP growth estimate to 1.7% from 1.6%, and set 2018’s estimate at 1.8%. Risks were considered more balanced following the defeat of populist parties in France and the Netherlands.

Source: www.bespokepremium.com

In Asia, the Bank of Japan (BOJ) increased their domestic Gross Domestic Product (GDP) growth estimate from 1.5% to 1.6% and more importantly, stated that the economy is expanding rather than recovering. First quarter corporate earnings showed noticeable year-over-year improvements. With China, we believe investors are underappreciating the power of the thriving middle class in China, with median incomes growing and consumerism representing a growth megatrend.

On a global basis, for the first time in six years, earnings estimate upgrades outnumbered downgrades. The Global GDP growth rate is projected to grow to 3.2% this year, up from 3.0% in 2016. While minor in absolute terms, we appreciate the positive direction of economic growth.

In May, market volatility picked up due to political concerns. While it is difficult to predict when it will strike again, we believe having a globally-diversified portfolio coupled with gold and alternative investments is the best strategy for a risk-balanced portfolio. We remain disciplined in our approach to finding worthy investment opportunities, with a laser-like focus on downside protection. As long-term value investors, we trust patience will be rewarded. Thank you for your continued confidence in us.

Barry Investment Team

In Other News

A new Department of Labor rule will raise all financial professionals who work with retirement plans or provide retirement planning advice to the level of a fiduciary, effective June 9, 2017.

As an independent advisory firm, The Barry Team has always put our clients first and acted in a fiduciary capacity.

This ruling will have a minimal impact on clients of Barry Investment Advisors.

Global Market Commentary (2015-2016)

The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.” William Arthur Ward

What to make of 2015? It was a year of global transitions. One where the Federal Reserve moved away from its zero interest rate policy to a rate raising cycle and handed off the stimulus baton to Europe. There was a shift to a world with potentially much lower oil prices than almost anyone expected, a time where multinational companies had to adjust to lower Chinese economic growth rates and an inflated value of the U.S. currency. It was also a year where the prices of the riskiest bonds that had historically offered higher yields fell in value to reflect their inherent risks. Even long-term U.S. government bonds were down in price as the long anticipated China sell down occurred. China unloaded hundreds of billions of them to help offset investment outflows. This had much less of an impact on prices than investors expected.

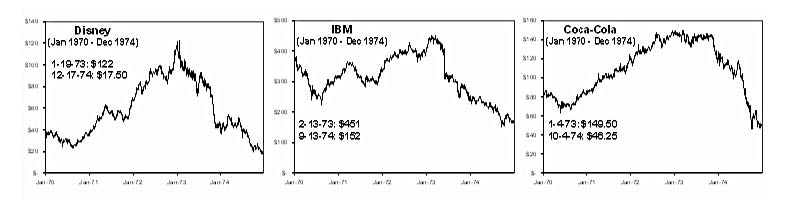

How should we interpret the events of 2015 to make wise decisions going forward? First let’s review what investors did in 2015. Investor responses to the rocky transitions made for an unusual year. Japan happened to be the best performing developed market. Initially, as we were expecting, many institutional investors moved their portfolios overseas toward Europe and Japan to take advantage of better valuations and corporate earnings growth. But during the second half of the year, market liquidity and headline worries had them reversing course. Some took solace in chasing the largest and most expensive stocks in the world, such as Facebook, Amazon, Netflix and Google, dubbed “FANG” by the media; marking 2015 as a year where it was fashionable to chase high fliers. These companies’ performance masked the fact that the price change of the average stock in the U.S. market was -3.78% without them. One of the economists we follow reminded us what a perilous strategy that can be - that buying companies “priced to perfection” may feel good at times, but usually ends very badly. In the 1970s companies dubbed “The Nifty 50” had P/E ratios two to four times the S&P’s average of 19x, and this one-dimensional investing created a lot of losses for investors back then. Today’s average FANG P/E ratio is 158x. Here are some examples of the Nifty 50 stocks from the 1970s:

Source: Marketthoughts.com

While it never feels good when the market is moving against us, it is helpful to revisit why we are value investors and review our principles as well as relevant lessons from the past. The fact that we are unwilling to pay for a company that is clearly priced over 20 times their profits helps us avoid steep losses, because there are additional downside risks in overpaying. While diversification is a good practice, there are years like 2015 where one can be tempted to increase investment in the areas that have continued to go up. History reminds us that keeping our diversified long-term value oriented strategy in place is advisable and to expect cycles in the markets to continue. We should be ready for out-of-favor areas that we are invested in to come back into favor, and not be surprised when the best areas in recent past lose their luster.

Global investors set expectations about economic growth and the markets often adjust based on what ultimately happens. What is also important is the direction growth is headed. Europe, Japan, and the Emerging Markets economic growth rates are expected to continue to improve, while the U.S. is expected to decelerate. With the combination of better valuations, continued stimulus, lower energy prices, and improving earnings of economies outside the U.S., we expect to be better off continuing to allocate portfolios globally.

Below are the current valuations of these markets:

Source: Morgan Stanly Capital International. Forward P/E as of 12/31/15

Even so, we won’t rule out a positive 2016 in the U.S. markets, in spite of its rocky start. The next chart shows that down moves in the stock market happen regularly, and yet, they don’t have much bearing on how well the year turns out. The red dots show the largest market drop occurring in each year and the solid bars reflect the gain or loss the market experienced for the calendar year.

Source: FactSet, Standard & Poor's, J.P. Morgan Asset Management

Currently we have found that diversification, as well as keeping some cash reserves, is the most effective way to manage volatility. We continue to research ways to reduce it.

So how do we adjust our sails?

As much as we like to think in one year periods, we need to keep in mind that markets and trends tend to shift over longer periods. It’s our ability to be patient, but also to adjust, that will determine how well we do over time. 2015 reminds us to be cautious of the risks out there and to continue to select carefully. The current market environment will provide opportunities to put more cash to work. Additionally, if interest rates rise in 2016, we won’t rule out owning more U.S. government bonds.

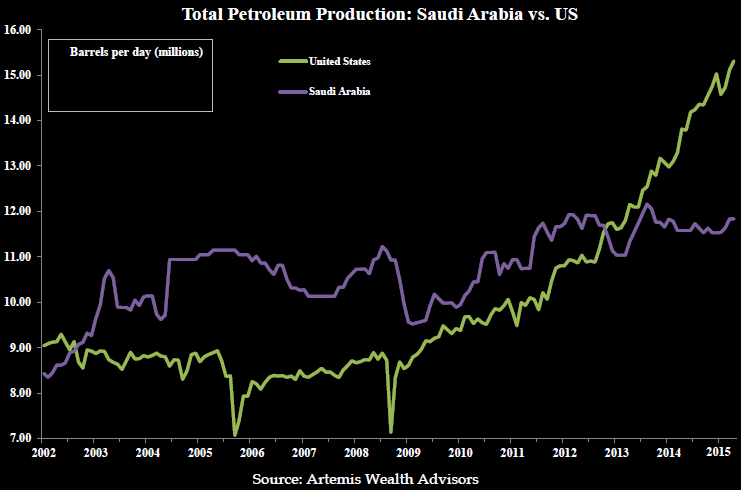

Markets are full of surprises. We are keeping our eyes on the many trends that are emerging in technology and healthcare et al., and will continue to recommend areas that look promising, but also are fundamentally sound. When change happens, we have to be ready to adjust accordingly. For example, who would have thought the U.S. would be producing more energy than Saudi Arabia?

The minute you get away from the fundamentals – whether its proper technique, work ethic, or mental preparation – the bottom can fall out of your game, your schoolwork, your job, whatever you’re doing.” Michael Jordan

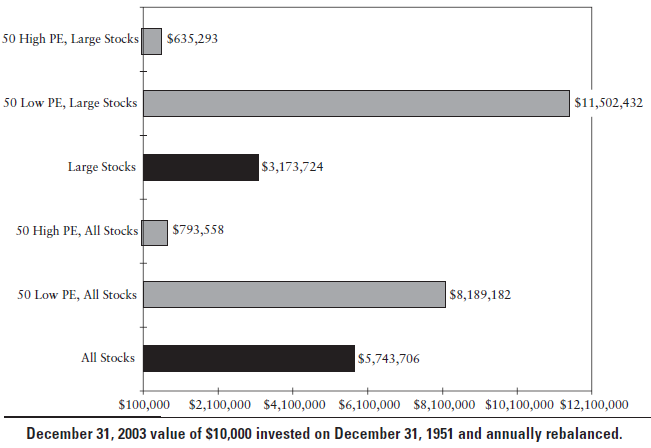

The chart below illustrates how value investing has performed historically:

Source: What Works on Wall Street

We are fundamental value investors because value investing has shown us to be the most reliable approach to grow portfolios over the long term. Your team looks forward to navigating you through 2016 and beyond.

Patrick J. Barry, Managing Partner, Joseph M. Barry, CFA