Lost Decade Ahead? Smart Investing Tips for Long-Term Investors

After nearly 15 years of strong market gains, interrupted only briefly by events like the Covid crash and the 2022 drawdown, investors have grown accustomed to stocks steadily climbing. But recent volatility, spurred by tariff tensions and rising geopolitical uncertainty, has served as a reminder that markets do not rise forever. Valuations, while slightly off their highs, remain elevated by historical standards, and across Wall Street, firms from Bank of America to J.P. Morgan are warning of the potential for a “lost decade” in the stock market. That is, a prolonged period where markets move sideways, offering minimal long-term returns despite ongoing ups and downs. For investors relying on their portfolios, especially retirees, this scenario can be daunting. But with the right strategy, a lost decade doesn’t have to mean lost progress.

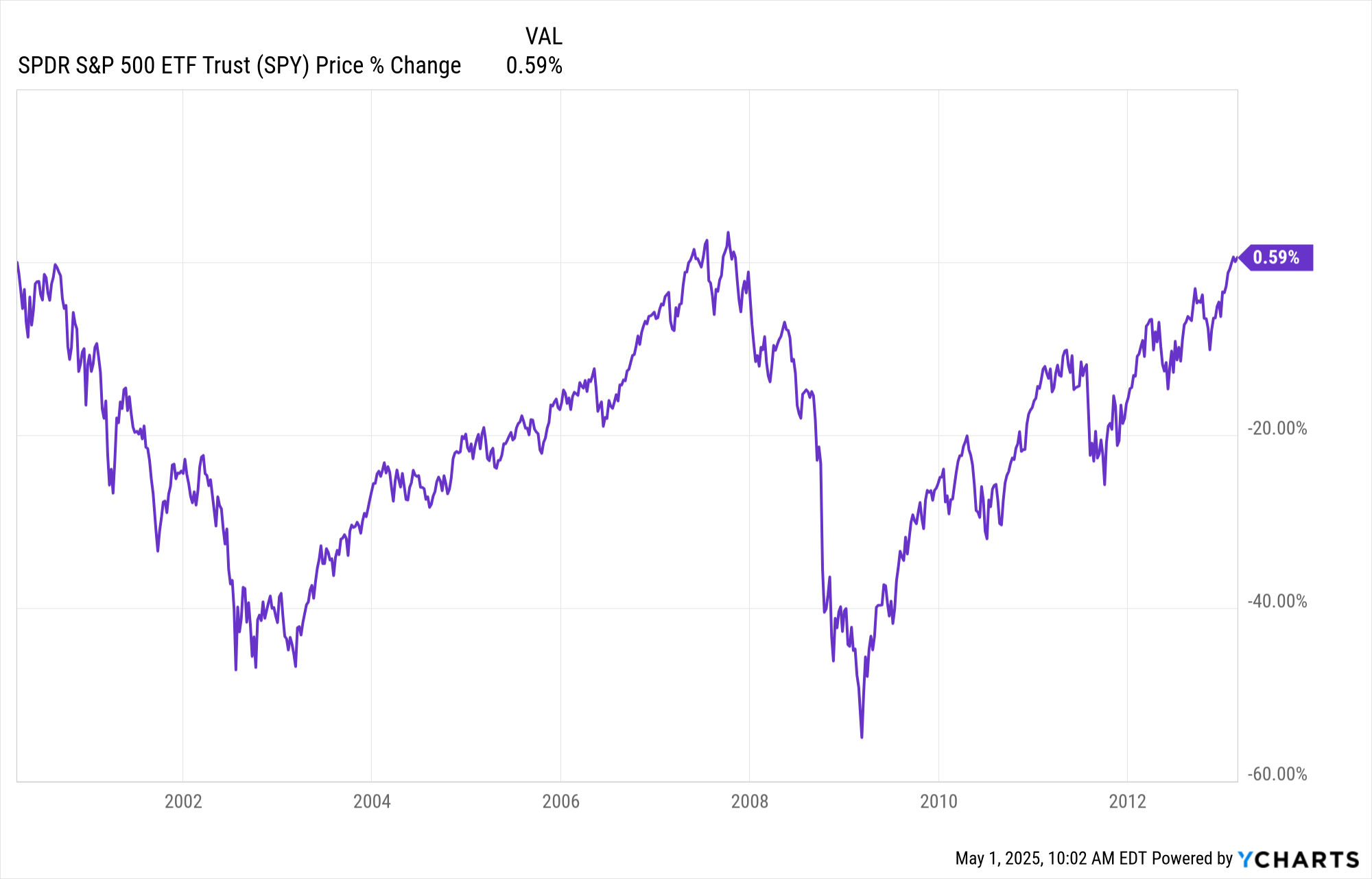

A lost decade, if you're not familiar, refers to a roughly ten-year stretch in which the stock market fails to produce meaningful gains. While there may be volatility, rallies, and corrections along the way, the overall return tends to hover around zero. Historically, these periods follow times of overvaluation and market euphoria. The dot-com bubble and the aftermath of the 2008 financial crisis are strong examples of how extended recoveries can test investor discipline.

For retirees on a fixed income, a decade of flat returns can pose a serious risk. Without a portfolio designed to generate income or provide some growth, they may be forced to sell assets during downturns just to fund everyday living expenses. This increases sequence-of-returns risk and can shorten the lifespan of their savings. For working Americans still contributing to retirement accounts, the prospect of a lost decade can feel just as frustrating; like pushing a boulder uphill with no visible progress.

But here’s the good news: even in a stagnant market, your investing efforts are not in vain. Long-term investing strategies like dollar cost averaging (DCA) can help mitigate the effects of market stagnation. By investing a fixed dollar amount at regular intervals, regardless of market conditions, DCA allows you to consistently buy shares; more when prices are low and fewer when prices are high. This approach helps smooth out volatility and can potentially improve returns over time, especially during periods of extended market weakness. Even if you weren’t aware of the dollar cost averaging strategy, the great news is you are likely already employing it. If you own dividend paying equities, those dividends are likely being reinvested and buying more shares every time they are received. Additionally, if you are participating in a workplace retirement plan like a 401(k), the contributions made from your paycheck are another form of dollar cost averaging!

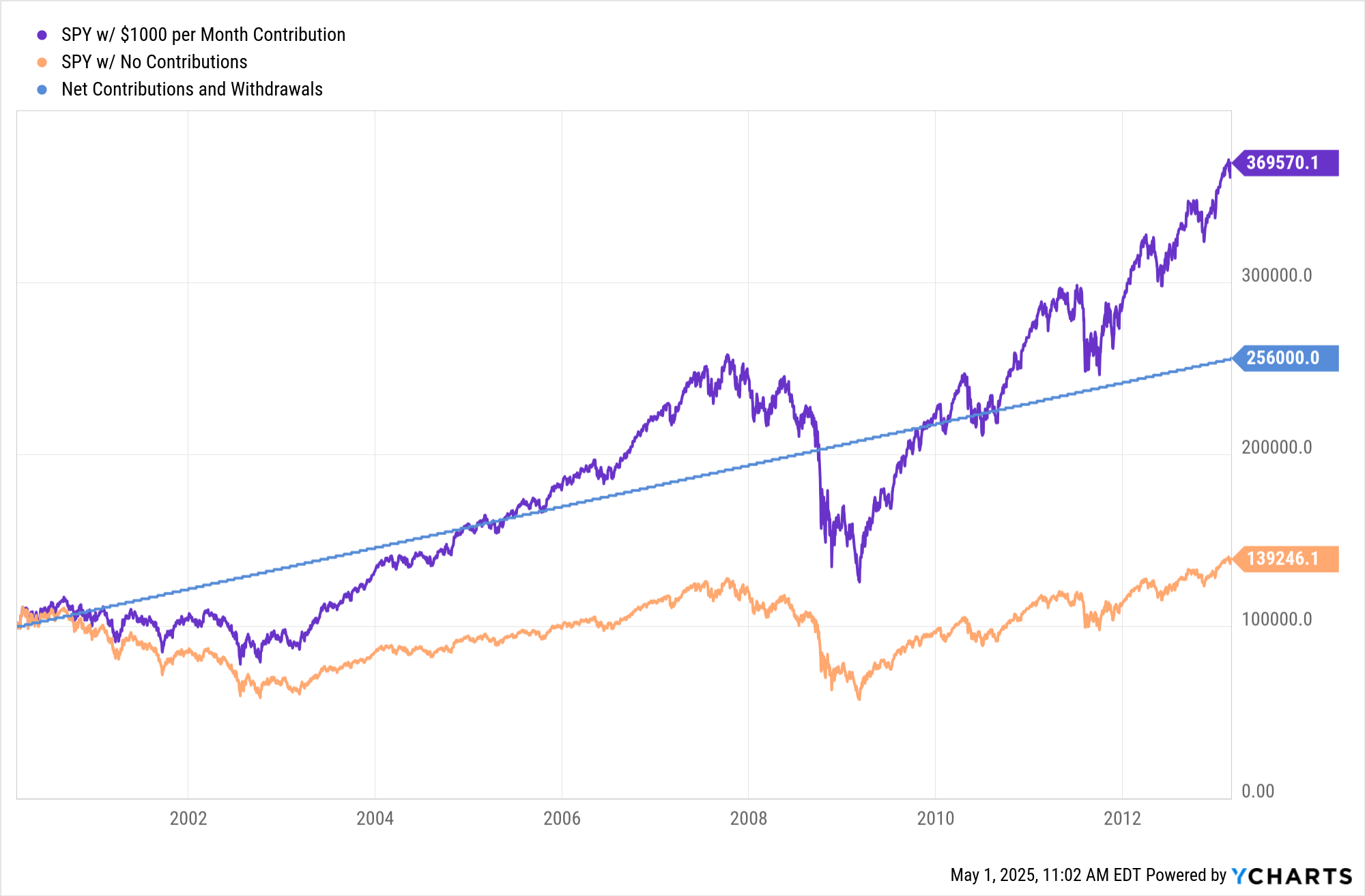

Let’s look back at the last major lost decade in the U.S. market: from around March 29, 2000 to March 1, 2013. This 13-year period saw the market slowly claw back to its dot-com bubble highs. If an investor had $100,000 invested in 2000 and then did nothing during that time, they would have finished 13 years later with…$100,000. Zero percent growth. And that’s before accounting for inflation. At first glance, this might seem like a warning to avoid investing during such periods altogether.

However, the smarter path is sticking to a disciplined investment plan. Let’s say that same investor instead chose to invest $1,000 per month consistently throughout those 13 years, using a dollar cost averaging approach. By the end of the period, they would have invested $256,000 and finished with $369,570. That’s a 44% total return over the so-called “lost decade”- or roughly 2.8% compounded annually.

While 2.8% may not seem like much, remember this happened during one of the most challenging investing environments in recent history. That’s the power of long-term thinking. More importantly, that investor was buying when prices were low, setting themselves up to benefit when the next bull market arrived. They were not trying to time the market. They were participating in it, consistently and without panic.

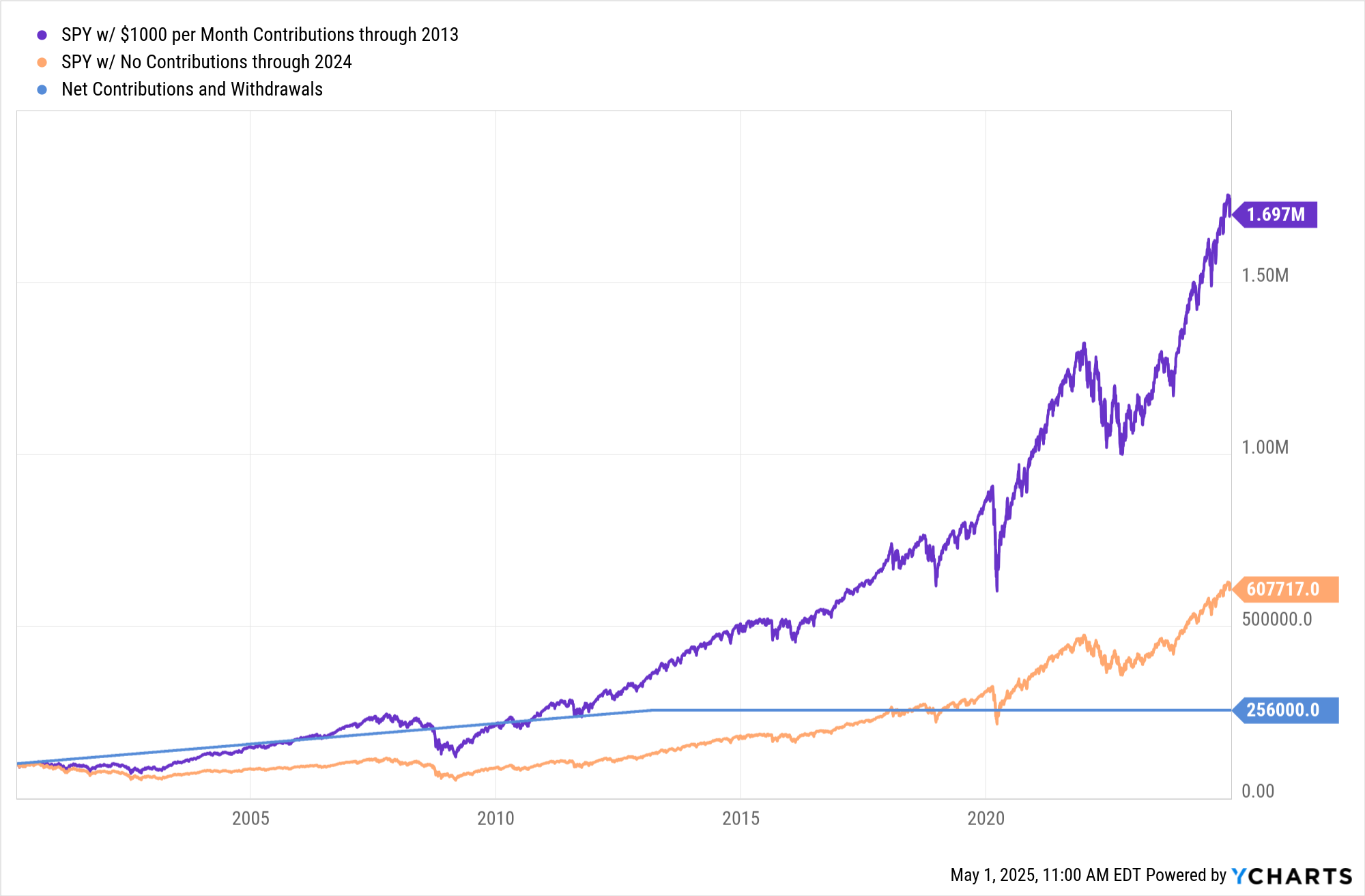

Now let’s fast-forward to 2024. Suppose our investor stopped investing altogether in March 2013, maybe they retired and were living off Social Security and a pension. Even without adding another penny to their portfolio, the disciplined DCA investor ends this scenario with approximately $1.697 million. That’s a 562% return on their total investment of $256,000.

Meanwhile, the investor who sat still with their original $100,000 since 2000? They would end up with just over $600,000. That’s still growth, but nowhere near the gains achieved by the investor who stuck to their plan during the down years.

The key takeaway? A lost decade in the stock market does not have to be a personal financial setback. For long-term investors, especially those with years or decades left before retirement, these periods can offer valuable buying opportunities. And for retirees, designing a portfolio that includes income-generating assets and avoiding emotional decision-making can help weather the storm.

Dollar cost averaging is not about market timing. It is about consistency and patience. If you continue investing through the valleys, you’ll be better positioned when the market eventually climbs again. Historically it has, and history tends to repeat itself.