Barry E-Mag – June 2025

Summer is nearly here, and while the markets may be taking a breather, our latest newsletter is anything but flat. This month, we’re serving up timely insights and helpful tips to keep your financial and personal life moving forward.

First up, our very own Wealth Advisor, Andrew Straus, dives into the value of dollar cost averaging- especially when markets seem stuck in neutral. It’s a steady approach that can help keep your investment plan grounded, even when the headlines are anything but.

Next, if you’re eyeing a summer move (or just ready to reclaim your garage), don’t miss our blog and attached video on how to declutter your home and sell it faster.

Finally, we’re sharing a thought-provoking lecture from Princeton Professor Arvind Narayanan, who explores a key question of our time: Is AI living up to its promises—or is it just digital snake oil?

Don't forget to make it to the bottom of the newsletter to stay up to date with the happenings of your BIA team!

If you have inquiries about the investment markets or your tailored wealth management strategy, please don’t hesitate to reach out to us!

Best regards,

The Barry Team

CHART OF THE MONTH

Source: BofA Global Research

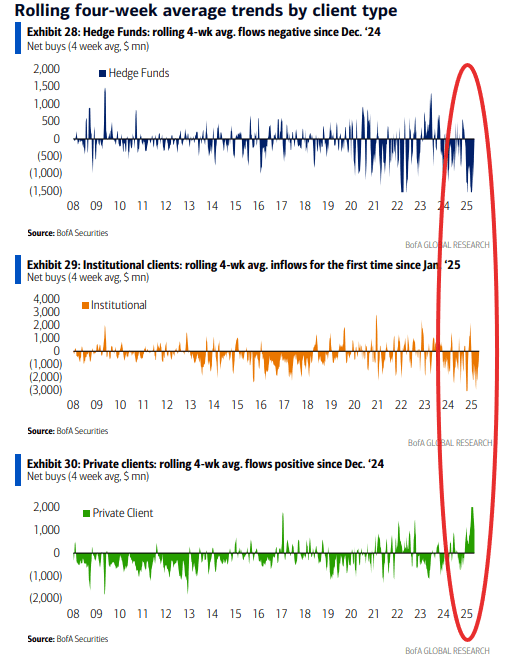

The top, middle, and bottom charts show four-week average net flows for hedge funds, institutional investors, and retail (private) investors, respectively. These charts reveal a notable divergence: hedge funds and institutions have been net sellers since early 2025, while retail investors have continued buying, with a record $40 billion in equities purchased in April alone. This divergence is a useful reminder that narratives from financial media often amount to noise, and when retail investors are aggressively buying while institutions remain cautious, it can serve as a contrarian signal worth watching.

INVESTING WISDOM

“Believe half of what you read and nothing that you hear.”

-Joseph M. Barry Sr circa 1955

LEGENDARY PLANNING IN ACTION

Getting older is hard, and not just because of the seemingly endless parade of new aches and pains we wake up to every day. As we edge our way closer to retirement, we have new concerns we carry with us: If I fall ill and require long term care can I afford it? How expensive is long term care likely to be in 10, 15, or 20 years? Do I need long term care insurance and if so, how much coverage do I need and what are the premiums? Who can I trust to find the right insurance plan for me?

These are difficult questions with answers that require careful consideration and change on a case-by-case basis. Thankfully the Financial Planning Team at Barry is experienced in providing guidance for this and many other critical planning scenarios. To provide an answer, the team employs every aspect of holistic financial planning; considering your dream retirement, future income and expense needs, modeling your present and future tax burden, the desire to leave an impactful legacy behind, and numerous other individual goals. We calculate break-even points and stress-test financial plans for resiliency in countless market and inflationary environments. Ultimately, we proffer our recommendation in a concise, easy to understand financial plan allowing you to make an informed decision on the path to retirement and beyond. As financial planners we do more than project numbers, we take anxieties about the future and turn them into actionable plans that allow our clients the freedom to focus on what matters to them most.

EMPLOYEE HAPPENINGS

The Barry Team took to the courts in a fierce and friendly evening of pickleball. Matches were won, matches were lost, but fun was had by all!

Whitney Holland's birthday was this past month. Many of you know Whitney as BIA's COO and Financial Advisor, but she is also a long time CPA. We could think of no better way to celebrate her birthday than with a cake in the form of every accountant's favorite tool, the ten key calculator!